IMPORTANT: TIME IS RUNNING SHORT

USD LIBOR will cease as a panel rate immediately after June 30, 2023. The time to act with respect to legacy transactions is now.

What you need to know

This is a brief update of impending changes to the London Interbank Offered Rate (LIBOR). LIBOR has been a long-standing index for financial transactions and is currently the most commonly used variable interest rate index for short-term interest rates, business loans, variable-rate loans, financial derivative contracts, and other commercial lending products.

Frequently asked questions

What is LIBOR and why is it important?

The London Interbank Offered Rate (LIBOR) is the most commonly used benchmark for short-term interest rates and often is referenced globally in documentation for derivatives, bonds, business loans and consumer financial products. The setting of LIBOR was, prior to the end of 2021, made daily on London business days by submissions of the average rates at which LIBOR panel banks believe they can obtain wholesale unsecured funding in 5 currencies (USD, GBP, EUR, JPY and CHF) and 7 maturities (from overnight to 12 months). After the end of 2021, the one-week and two-month USD LIBOR publication ended and the representative publication of LIBOR in all non-USD currencies ended. It is estimated that up to $200 trillion of financial instruments (loans, bonds, derivatives and consumer financial products) have been tied to USD LIBOR and that matters to everyone – small businesses, corporations, banks, broker dealers, consumers and investors.

What is happening with LIBOR and why transition away from it?

In March 2021, LIBOR’s administrator and regulator have confirmed the endgame for USD LIBOR. The ICE Benchmark Administration (IBA) ceased publication of the one-week and two-month USD LIBOR tenors immediately after December 31, 2021, and the remaining tenors (i.e., Overnight/Spot Next, 1-month, 3-month, 6- month and 12-month) will cease on a representative basis immediately after June 30, 2023. The period between end- 2021 and mid-2023 is primarily intended to allow legacy contracts to mature or to be amended.

U.S. federal banking regulators stated that using USD LIBOR as a reference rate for new contracts after December 31, 2021 would create safety and soundness risks, other than in certain limited circumstances.

Transition to alternative benchmark interest rates has been well underway, but much work still is needed in order to implement a successful reference rate change.

Additionally, as of December 31, 2021, the IBA ceased publication of all Sterling, Euro, Swiss Franc, Japanese Yen LIBOR settings on a representative basis.

What is the role of the ARRC?

In 2014, the U.S. Federal Reserve and the New York Federal Reserve Bank (NY Fed) established the Alternate Reference Rates Committee (ARRC) to lead the transition away from LIBOR. It recommended the Secured Overnight Financing Rate (SOFR) as the replacement for USD LIBOR and encouraged the development of a SOFR futures market.

For the most recent information about the ARRC, please visit here.

What is SOFR?

In June 2017, the ARRC identified SOFR as the recommended alternative reference rate for USD LIBOR. SOFR is a broad measure of the cost of borrowing cash overnight, collateralized by U.S. Treasury securities (each a repurchase or repo transaction). While LIBOR is not fully transaction based, SOFR is based on an overnight repo market with ~ $1 trillion of transactions per day. The NY Fed is the administrator and producer of SOFR. Publication of SOFR began in April 2018.

Trading and clearing of SOFR based futures and SOFR-based swaps began in 2018.

How is SOFR calculated?

SOFR is calculated as a volume-weighted median of transaction level tri-party repo transaction data, General Collateral Finance repo transaction data and data on bilateral U.S. Treasury repos cleared through the Fixed Income Clearing Corporation's delivery-versus-payment service provided by Depository Trust & Clearing Corporation (DTCC) Solutions LLC. SOFR is published each business day on the NY Federal Reserve’s website.

Does the ARRC have a timeline for the adoption of SOFR?

In July 2022, the ARRC published its Legacy Playbook detailing recommendations for the transition of legacy USD LIBOR cash products. This Legacy Playbook discussed Contract Assessment, Contract Remediation, Fallback Communication and Implementation. The Legacy Playbook (located here) also included a compilation of publications by the ARRC and links to relevant reference materials.

In October 2022, the ARRC released Loan Remediation Survey Results detailing information on lenders’ and borrowers’ steps underway, as well as plans going forward to remediate USD LIBOR business loans.

In April 2021, the ARRC published its progress report on the transition from USD LIBOR, outlining key reference rate reform efforts, progress to date, and areas requiring further work. The “Progress Report: The Transition from U.S. Dollar Libor” also included the ARRC’s 2021 Objectives and Priorities to support a smooth and efficient transition from LIBOR.

In September 2020, the ARRC updated its recommended Best Practices for Completing Transition From LIBOR, originally released in May 2020. The ARRC’s Best Practices were intended to clarify the timelines and interim milestones for floating rate notes, business loans, consumer loans, securitizations and derivatives that the ARRC believed were appropriate for transitioning away from LIBOR in order to minimize market disruption and support a smooth transition to SOFR.

ARRC’s Recommended Best Practices for Completing the Transition from LIBOR can be found here.

What is the LIBOR Act?

The Adjustable Interest Rate (LIBOR) Act was signed into law as part of the Consolidated Appropriations Act, 2022 (available at: https://www.congress.gov/117/bills/hr2471/BILLS-117hr2471enr.pdf, see pgs. 777-786). The LIBOR Act, among other things, provides a targeted solution for certain financial contracts that mature after June 30, 2023 and have no effective means to replace USD LIBOR upon its cessation. The Federal Reserve’s Final Rule (located here) implementing the LIBOR Act became effective on February 27, 2023. The LIBOR Act and the Final Rule have identified adjusted SOFR-based rates to replace USD LIBOR for affected contracts. However, the LIBOR Act may not serve to transition many contracts that have otherwise practicable fallback provisions.

For existing contracts referencing LIBOR and transitioning to SOFR, do any adjustments need to be made to SOFR to make the economics of the transaction comparable to those based on LIBOR?

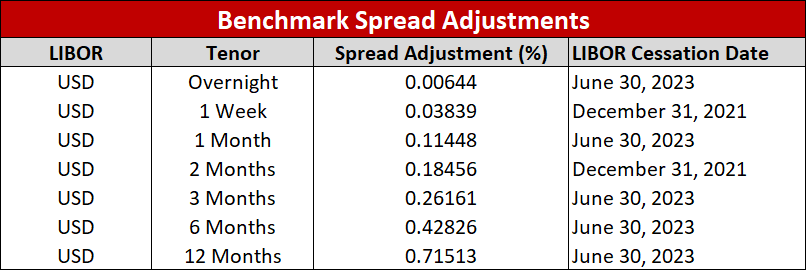

As noted by the ARRC, LIBOR and SOFR have different characteristics, and where a LIBOR contract is falling back to SOFR, a spread adjustment would need to be added to make the rate more comparable to LIBOR. Therefore, both the ARRC-endorsed fallback language and the fallbacks codified in the LIBOR Act and the Final Rule provide for static spread adjustments that were fixed on March 5, 2021.

These fixed spread adjustments for USD LIBOR fallbacks were based on a 5-year historical median of the spread between the relevant USD LIBOR tenor and SOFR. The spread adjustments recommended by the ARRC and codified in the LIBOR Act for non-consumer cash products are the same as ISDA’s spread adjustments for USD LIBOR.

However, even with a credit spread adjustment, no replacement benchmark is likely to be neutral to all parties; some will benefit and others will not.

What happens to the existing transactions and contracts?

A transaction that references LIBOR and matures or expires after the time LIBOR is expected to be unavailable will possibly need to be amended. A certain subset of contracts may transition to a replacement rate, as a result of the fallback provisions therein or as a result of the implementation of the LIBOR Act.

What is happening to new transactions entered into now and in the future?

Almost all new transactions entered into by MUFG utilize an alternative reference rate instead of LIBOR.

What is a fallback provision?

It is a provision in the agreement for a loan, bond, derivative or another financial instrument specifying a new interest rate benchmark or negotiation process to be followed by the transaction’s parties to determine a replacement rate if the interest rate used in that contract becomes unavailable. The ARRC recommended fallback provisions for USD LIBOR-dependent syndicated and bilateral loans, floating rate notes, securitizations, and residential adjustable rate mortgages to help transition away from LIBOR when it becomes unavailable. Those recommended provisions can be found here.

A contract may contain a fallback provision that can be operationalized upon the unavailability of LIBOR.

Given that SOFR is an overnight rate, will forward looking term SOFR be available?

On July 29, 2021, the ARRC formally recommended the Chicago Mercantile Exchange (CME) Group’s forward-looking Secured Overnight Financing Rate term rates (TERM SOFR). The announcement was a milestone in the industry’s transition away from USD LIBOR, marking the completion of the Paced Transition Plan that the ARRC outlined in 2017. These rates are officially published on the CME website. Similar to LIBOR, the following TERM SOFR tenors are available: 1, 3, 6 and 12 months. It should be noted that the ARRC has recommended a limited scope of use for TERM SOFR in order to support a robust, sustainable transition and help ensure financial stability. The ARRC’s Best Practice Recommendations Related to Scope of Use of the Term Rate can be found here.

What is “synthetic” LIBOR?

The UK’s Financial Conduct Authority (FCA), the regulator of the ICE Benchmark Administration (IBA), which is the administrator of LIBOR, announced in November 2022 that it was consulting on its proposal to require the publication of 1-, 3- and 6-month USD LIBOR settings on a “synthetic” basis for a temporary period from June 30, 2023 until September 2024. The FCA emphasized that, if it decides to compel such publication, synthetic USD LIBOR would not be “representative” of market conditions that the original LIBOR settings were intended to measure. The FCA also made clear that its primary purpose in requiring the publication of synthetic USD LIBOR is to facilitate an orderly transition of legacy contracts that are governed by UK or other non‑US law, and that have no realistic prospect of being amended by the time LIBOR is no longer published in its current form at end-June 2023. The FCA’s final decision is expected to be announced in late Q1/early Q2 2023.

If synthetic USD LIBOR for such tenors is published, it may impact transition options for certain LIBOR contracts.

Where can I get updates regarding the ARRC and the IBOR transition process?

The ARRC periodically publishes a newsletter with key news updates relating to the LIBOR transition and can be found here.

What is the current status of initiatives of the International Swaps and Derivatives Association (ISDA) for fallback language supporting LIBOR transition for derivatives (non-cash products)?

On October 23, 2020, ISDA has published a Supplement 70 to its 2006 Definitions for derivatives contracts that became effective on January 25, 2021. New transactions that incorporate the ISDA definitions and reference USD LIBOR or certain other IBORs will incorporate fallbacks upon specified cessation events for such IBORs to one or more “risk free” reference rates (each a fallback rate) together with a published spread adjustment.

On October 23, 2020, ISDA also published the 2020 IBOR Fallbacks Protocol (the 2020 Fallbacks Protocol) to enable market participants to amend their legacy uncleared derivatives and certain other contracts with other adhering parties to include the new fallback rates. The 2020 Fallbacks Protocol generally covers certain IBOR transactions (including USD LIBOR transactions) that are governed by ISDA master agreements, ISDA credit support documentation, certain confirmations, certain local law swaps and derivatives master agreements, repurchase agreements and securities lending agreements. ISDA has also published templates that parties may employ to bilaterally incorporate the 2020 Fallbacks Protocol terms or to otherwise amend, include or exclude certain master agreements or transactions from the scope of coverage of the 2020 Fallbacks Protocol.

On June 11, 2021, ISDA published the first version of the 2021 ISDA Interest Rate Derivatives Definitions (the 2021 ISDA Definitions), which are expected to succeed the 2006 ISDA Definitions as the market standard definitional booklet for the interest rate derivatives markets. The 2021 ISDA Definitions include fallbacks for LIBORs and certain other benchmarks. ISDA continues to update and publish new versions of the 2021 ISDA Definitions.

ISDA continues to publish additional materials for use by market participants to facilitate LIBOR transition, such as FAQs, new confirmation templates, updated and additional standard definitions, disclosures and matrices covering a range of provisions such as business days, floating rates, compounding and averaging terms, and cash settlement provisions. The FAQs and additional information are available on the ISDA website.

Is MUFG actively working on the transition away from LIBOR?

Yes. MUFG established an enterprise-wide IBOR Transition Office in 2019 to manage the transition for our customers and provide oversight for the company. In an effort to mitigate the risks associated with a transition away from LIBOR, MUFG has undertaken initiatives to: (i) develop more robust fallback language and disclosures related to the LIBOR transition, (ii) develop a plan to seek to amend certain legacy contracts to reference such fallback language or alternative benchmark rates and amend such contracts, (iii) launch and enhance systems to support new products linked to alternative benchmark rates, (iv) develop and evaluate internal guidance, policies and procedures focused on the transition away from LIBOR to other benchmark rates, (v) prepare and disseminate internal and external communications regarding the LIBOR transition and (vi) address any legacy LIBOR contracts that remain unamended at the time of LIBOR cessation as a representative rate.

What should my company or business do right now?

(1) Lean more about LIBOR cessation, transition and replacement rate developments; (2) analyze your LIBOR exposure with a focus on financial instruments maturing beyond June 30, 2023 and what effect the discontinuation of LIBOR might have on that exposure (including with respect to any transitions that may occur as a result of a contractual fallback provision or effect of the LIBOR Act); (3) engage with your counterparties, vendors and financial institutions now to identify and amend LIBOR-dependent contracts ahead of June 30, 2023; and (4) consider the impact that a change to a replacement rate may have on accounting, tax, IT, systems and operations.

Additional Resources

Follow these links for news and other resources from some of the key industry participants in LIBOR transition:

Alternative Reference Rates Committee (ARRC) (US)

Loan Syndications & Trading Association (LSTA) (US)

Mortgage Bankers Association (MBA) (US)

International Swaps and Derivatives Association (ISDA)

Disclaimer: The areas and issues covered by this website are continually evolving and you should consult relevant sources and your advisors. Links to some of the relevant working and trade groups are incorporated in the information included on this website. MUFG makes no representation as to the accuracy, completeness or timeliness of such information, which may also be subject to change. The information provided herein is provided for informational purposes only, is not intended to be exhaustive and does not constitute, and should not be relied upon as, legal, regulatory, financial, tax, accounting or other advice. MUFG is not providing any such advice and does not act as your fiduciary. You should consult with your own advisors on the impact of the potential cessation of LIBOR on your business and affairs. MUFG does not warrant or accept responsibility for, and shall not have any liability with respect to, (a) whether the composition or characteristics of any alternative, successor or replacement rate to LIBOR (including SOFR) will be similar to, or produce the same value or economic equivalence of, or have the same volume or liquidity as, LIBOR or (b) the costs, expenses or the consequences related to the cessation of LIBOR or the transition to an alternative, successor or replacement rate thereto. None of the information contained herein represents a commitment or a firm offer to transact, nor does it obligate MUFG to enter into any such commitment.