Unlock Liquidity and Optimize Your Working Capital

At MUFG, we provide innovative Trade Receivables Securitization solutions designed to help companies efficiently manage cash flow and gain access to cost-effective revolving debt. With decades of expertise in structured finance, we offer businesses an opportunity to transform their receivables into liquidity, freeing up working capital to fuel growth.

What is Trade Receivables Securitization?

Trade Receivables Securitization is a receivables-backed line of credit, that is committed and non-recourse. It is a financial solution where a company sells its accounts receivables to a special purpose vehicle (SPV). The SPV then grants a lien to the receivables in exchange for loan proceeds, which is raised through banking institutions, providing a lower-cost, flexible source of debt.

This allows companies to:

- Access funding at competitive rates.

- Improve cash flow predictability.

- Optimize working capital and focus on business growth. (i.e. deploy proceeds for acquisition financing, refinance higher cost debt, etc.)

Key Benefits

- Lower Cost of Funding: Tap into more affordable capital through securitization.

- Committed and Flexible Revolving Structure: Comfortably fund short- to medium-term needs across business lines and expand with rapid growth without added cost.

- Seamless Execution: Benefit from our deep expertise in structured finance and trade receivables management.

How Our Solution Works

MUFG partners with businesses to tailor receivables securitization programs that meet their specific needs. Our expertise in structured finance enables us to provide guidance throughout each step of the process, from structuring the Special Purpose Vehicle (SPV) to ensuring ongoing monitoring of receivables performance.

Lower cost of funding is achieved through implied highly investment grade rating of transaction. Although receivables securitizations are not externally rated, they achieve internal ratings that are equivalent to “A” to “AAA” risk, resulting in favorable pricing. This is achieved through tools such as bankruptcy remoteness and credit enhancement.

Here’s a detailed look at the transaction structure and the methodology used to calculate funding.

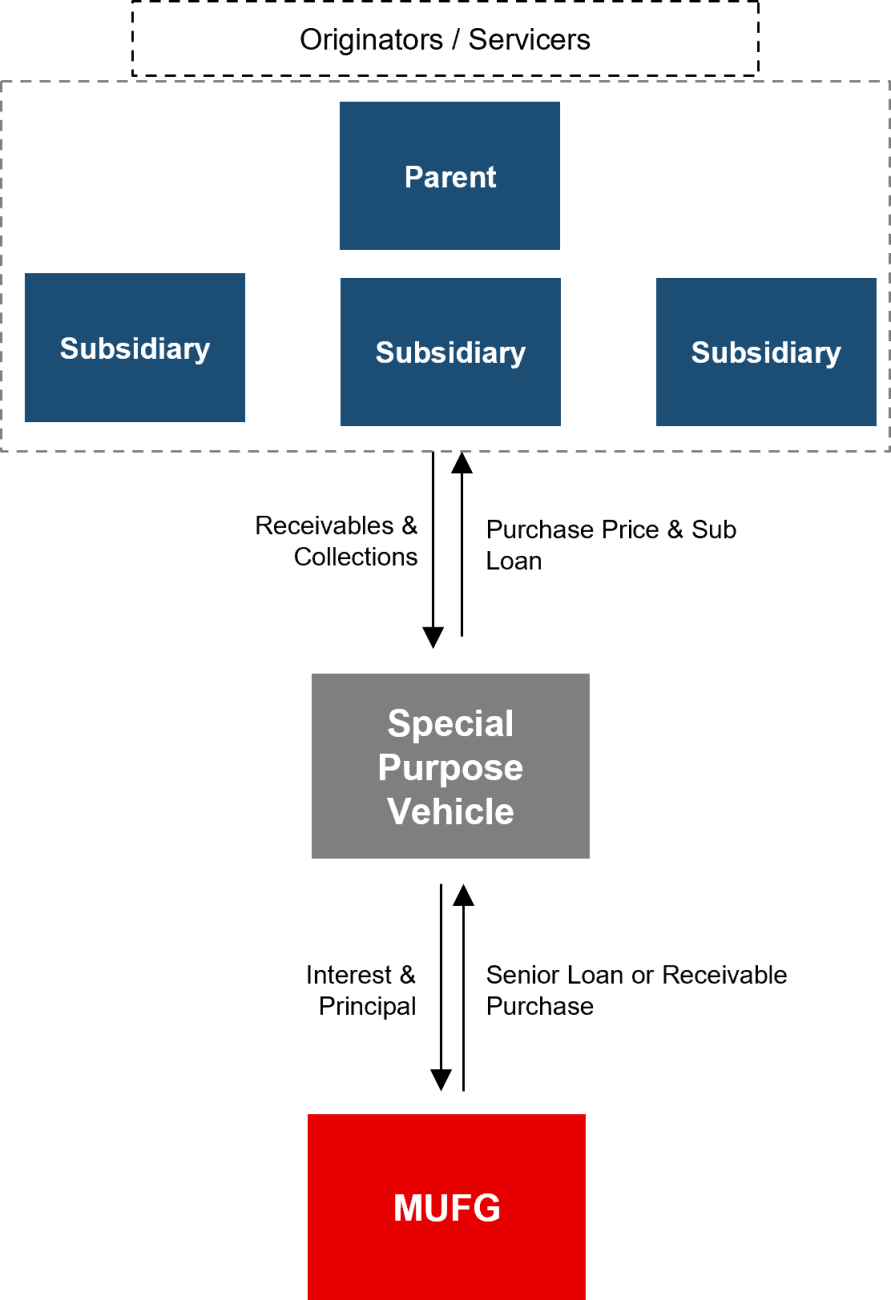

Transaction Structure - Bankruptcy Remoteness

Two-Step Process

The following illustrates how receivables are sold in exchange for a line of credit.

The company sells receivables to a bankruptcy-remote Special Purpose Vehicle (“SPV”) on a daily basis.

The SPV is typically a wholly-owned entity that’s set up as a bankruptcy-remote entity to separate the assets from the company’s corporate credit risk. This is key because these are non-recourse facilities, so lenders can only look to the receivables to pay them out in an event of bankruptcy.

- The lenders are then granted a lien in the receivables that are in the SPV and in exchange, provide a line of credit to the company.

Key Points

- Structure: True sale of the receivables to the SPV. The Originators sell receivables to the Purchaser on a daily basis.

- SPV: Newly formed SPV that is wholly owned by the Originator.

- Originators / Servicers: The Company and its subsidiaries. If the Originator is a subsidiary of the Parent and is not a rated entity, the Parent will provide a Parent Undertaking covering the activities of the subsidiaries.

- Parent Undertaking does not constitute a financial guarantee for the performance of receivables being securitized.

- Servicing Activities: Origination and collection of receivables under the normal course under the company’s existing credit and collection policies. Maintaining records and reporting under the securitization program.

- Facility is not expected change the Company’s operations and is transparent to the obligors.

- Lenders: One or more financial institutions. Banks will fund the transaction using their balance sheet or through an Asset Backed Commercial Paper (“ABCP”) Conduit.

Structure Diagram

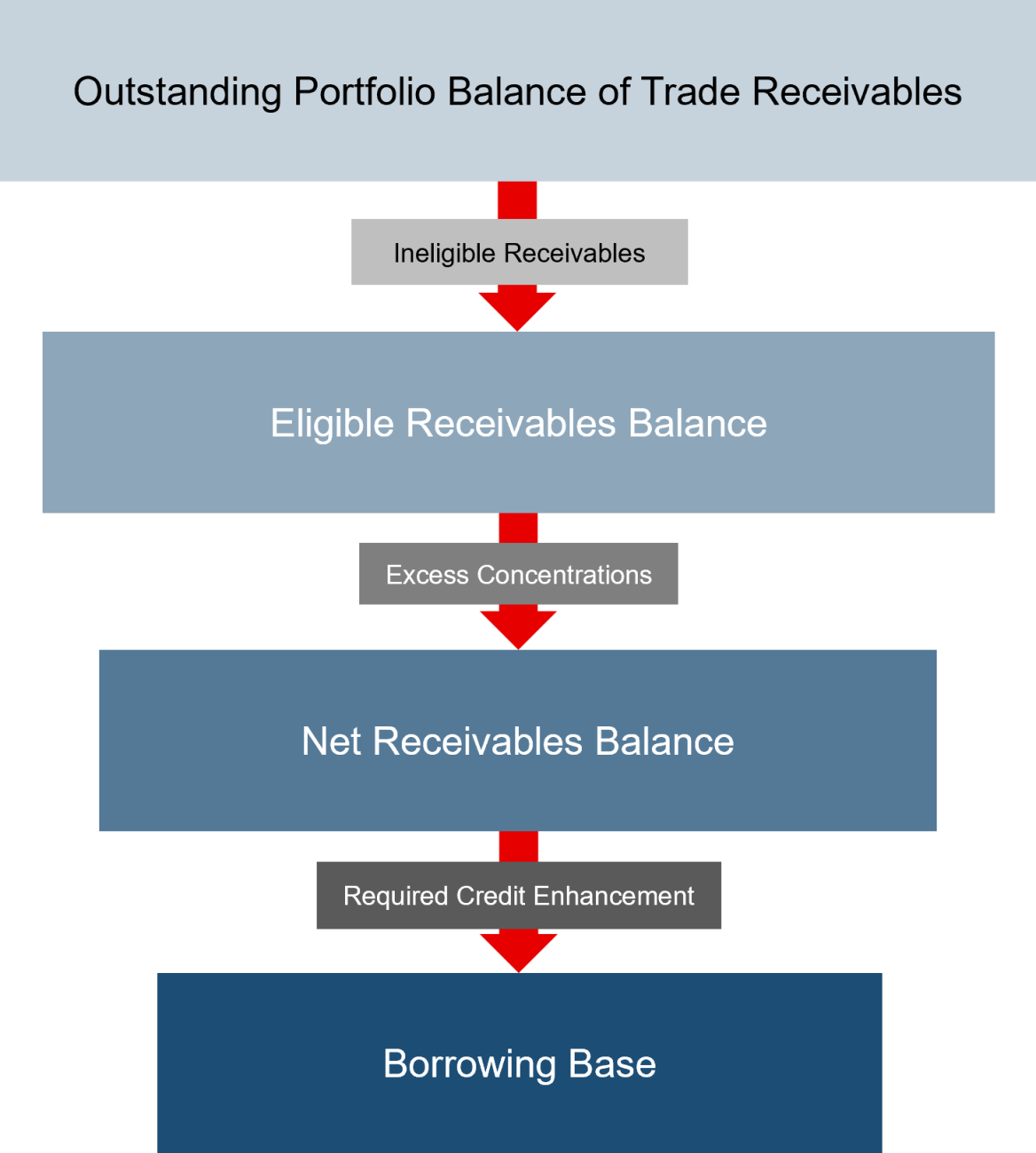

Calculating the Amount of Funding – Credit Enhancement

Eligibility Criteria

- The total pool of receivables sold are “filtered” by eligibility criteria; Ineligible Receivables are not eligible for funding based on invoice level characteristics.

- Once filtered, the Eligible Receivables Balance is adjusted by Excess. Concentrations which limit exposure in the pool to any one or any group of customers depending on their. respective rating. Put another way, these reductions are based on pool-level characteristics.

- The resulting pool of receivables is the Net Receivables Balance (“NRB”).

- An advance rate on the NRB is then calculated in line with rating agency methodology by subtracting the Required Credit Enhancement to determine the maximum Borrowing Base the pool can support.

- Required Credit Enhancement is typically sized to account for the following:

- Reserve ratio for losses in the receivables pool (“Loss Reserve”).

- Reserve ratio for dilution (i.e. credit memos) in the receivables pool (“Dilution Reserve”).

- Reserve ratio for yield and servicing fees (“Yield and Servicing Fee Reserve”).

- Required credit enhancement is also subject to a minimum credit enhancement floor that is sized based on customer concentrations.

Step-by-Step Process to Determine Financing Volume

Why Choose MUFG?

As one of the world’s leading financial institutions, MUFG offers a combination of global reach, unparalleled access, and unmatched client support with a dedicated team of securitization professionals. Our Trade Receivables Securitization solutions are designed to enhance your liquidity while maintaining control over your receivables management.

Industries We Serve

We support businesses across a wide range of industries, including but not limited to:

- Industrials

- Media & Technology

- Energy

- Healthcare

- Utilities

- Transportation

- Consumer Goods

- and more

Get in Touch

Ready to unlock the value of your trade receivables? Contact Eric Williams today to learn more about how our Trade Receivables Securitization solutions can enhance your business' financial flexibility.