MUFG Americas

1251 Avenue of the Americas

New York, NY, 10020-1104, United States

ePayables

An ePayables card program is introduced into your accounts payable stream at the point your transactions have been approved for payment through your existing Enterprise Resource Planning (ERP) or other system. The only change to your existing process is that the method of payment becomes a card rather than a check. Your process for approval remains the same, making the transition to ePayables easy and efficient. This means that an ePayables program is ideal for companies who are attempting to expand their existing commercial card programs or companies who are first considering venturing into a card program. The end result is that checks will be eliminated and payment efficiencies gained through the transition to card payments, ultimately leading to real cost savings within your payables flow. Since ePayables cards enable payment on approved supplier invoices, your card program can be expanded to suppliers who provide inventory and even capitalized goods. In fact, ePayables cards are most appropriate for your higher-dollar transactions with programs designed to manage both high- and low-frequency payments. ePayables programs can be structured so that even your most cost-sensitive suppliers find that accepting card payments is a costeffective solution. Finding ways to enhance supplier partnerships is often a strategic goal of many companies, and the right supplier enablement program can help make that happen.

Virtual cards focus on specific transaction types

After an analysis of your supplier relationships, your supplier targets will begin to emerge. Understanding the profile of the suppliers you want as participants in your ePayables program will help AP dive into the next step, which takes a closer look at many factors that impact both you and your suppliers from the initial purchase through the payment process.

Leveraging Both Sides of the Payment Equation

Having a solid appreciation for the supplier viewpoint sets the foundation for constructing a compelling and equitable ePayables transformation strategy. Armed with this more equitable mind-set, negotiations can take on a dialog that is more “partnership” in nature as supplier-specific benefits of ePayables are considered. When comparing buyer and supplier benefits as in the following table, it becomes clear there are cause and effect interactions with some features acting as push/pull “levers.” Buyers can leverage some of the significant benefits gained from Electronic Accounts Payable (EAP) to “share” the advantages with their supplier, helping them recoup the added cost of merchant discount fees associated with card payments.

| Payment Feature (Buyer and Supplier Impacts) | ePayables Trade-offs | |

|---|---|---|

| Buyer | Supplier | |

| Interchange: Buyers can benefit from a “rebate” of the interchange paid to their card issuer to cover the cost/risk of processing card transactions. The interchange, however, is derived from the merchant discount fee paid by the supplier. Buyers have the ability to lower the supplier’s discount fees by influencing the level of interchange associated with the transaction. Buyers increase rebate-qualifying spend while influencing/lowering supplier discount fees associated with EAP transactions. |

+ Earn higher rebate percentage (increased card volume, new EAP categories) – Lower rebate percentage as transaction size increases |

– Merchant discount fee is paid on transactions + Reduce “standard” discount fee paid by accepting lower interchange transactions + Faster (guaranteed) payments + Reduced collection expenses and bad debt |

| Early Payment Discount Terms: Buyers willing to forgo early payment discounts in exchange for the extended bank billing terms and interchange rebates will help the supplier recoup the cost of the Merchant Discount Fee. |

+ 30-day card billing cycle retains/extends payment “float” + Earn rebate on card transactions – Eliminate the discount offered by the supplier |

– Merchant discount fee is paid on transactions + Early pay discount on invoices is eliminated/reduced + Gain/retain faster (guaranteed) payments |

| DPO (Days Payable Outstanding): Buyers are able to maintain or improve their “float” (DPO), typically paying their bank for the card-based transactions within 30 days on average, and make up for any costs associated with lost float with additional rebate paid by the bank. Buyers leverage extended bank card terms while improving/reducing payment cycle to suppliers. DSO (Days Sales Outstanding): Suppliers may be paid much faster when they accept VCNs, giving quicker access to working capital and lowering cost of funds. Suppliers pay a discount fee in exchange for guaranteed faster payment. |

+ Retain/extend DPO up to 30 days (average) while maintaining and/or shortening supplier payment terms + Increase rebate on new EMV volume + Maintain/increase working capital |

– Merchant discount fee is paid on transactions + Buyer agrees to faster payment terms reducing DSO and gaining faster access to funds + Potential to reduce cost of funds, i.e., factoring |

| Payment processing time and costs: Buyers’ manual processing time and costs associated with matching invoices, check writing, mailing payments, and reconciliation are greatly reduced with VCNs compared to check, ACH, and wire payments. Suppliers accepting VCNs avoid remittance processing time and costs including mail processing or lockbox fees, cash application, reconciliation, payment processing, deposit costs, and collections. Buyers and suppliers can reduce processing time, errors, and costs. |

+ Eliminate manual processing time and cost associated with other payment methods + Reduce errors |

+ Eliminate incremental check deposit time, making funds available faster + Reduce remittance processing and collections cost |

| Remittance data: The reconciliation process for both buyers and suppliers is automated with unique VCNs linked to remittance data. By providing the details with the payment transaction (based on invoice data), this avoids the need for a separate remittance file and a more manual reconciliation process. Buyers and suppliers are able to automate more or all of their reconciliation processes. |

+ Reduce or eliminate the need to provide remittance data + Eliminate the need to maintain supplier’s bank data |

+ Receive standardized remittance data and unique VCN that automates reconciliation process + BIP model eliminates supplier need to initiate the card payment or to share bank information (EFT) + Electronic remittance data enables automatic posting to AR |

Comparing these payment dynamics and expenses across card-based payments versus other payment methods, buyers can begin to lay out a much more promising picture with targeted suppliers.

- A typical large-ticket $10,000 transaction will have cost of capital and remittance processing fees likely higher than merchant discount fees, especially when the lower Commercial Payments Account (CPA) interchange rates with EAP are processed by the supplier. CPA interchange was introduced by Mastercard to provide even lower interchange rates than large-ticket rates. CPA encourages further expansion of EAP transactions to include even larger strategic payments, with specific interchange rates for transactions ranging from $10,000 to over $1 million.

- Suppliers are paid much faster. Receiving payments faster creates value to suppliers. The lower DSO improves working capital by reducing the need and cost to borrow funds and enabling faster reinvestment of funds for increased ROI.

- A typical cost of invoice processing and payment by check is $39.1 By accepting VCNs, suppliers can eliminate costly and labor-intensive AR processes including cash application, problem resolution, and collections. Further, supplier reconciliation processes and costs are greatly improved, given that invoice details accompany each payment.

Taking a broader look, suppliers are able to realize several service-related “soft” revenue benefits by accepting card-based payments:

- Buyers increase overall purchase volume with suppliers accepting card payments; in fact, 50% of EAP purchases are for operating expenses (including operating goods and supplies, office equipment and supplies, and computer-related hardware and software).1

- Suppliers achieve revenue consistency when buyers, satisfied with the more streamlined process, make more frequent, regular purchases. The supplier achieves a more predictable influx of working capital, improving cash flow.

- According to the 2018 RPMG Purchasing Card Benchmarking Survey, the percentage of respondents that are “satisfied” or “very satisfied” with supplier acceptance of EAP has nearly doubled, growing from 24% in 2015 to 45% in 2018.1

- By understanding the give-and-take relationship between these payment dynamics and how they relate to your target short list, you are now positioned to build a more customized campaign strategy to get your suppliers on board. Your diligence with helping suppliers realize a more holistic set of benefits will give you the advantage in negotiations, leading to more partnerships and maximizing your EAP transformation success. And always remember: you are a supplier, too. Be just as willing to accept virtual card transactions as you are to pay with them.

ePayables Overview

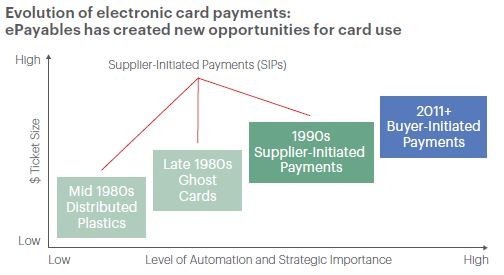

Purchasing cards: Buyers distribute plastics to employees to pay for Maintenance/Repair/Operations (MRO) items.

Ghost cards: Buyers assign account numbers to departments or suppliers to pay for repetitive or recurring expenses.

Supplier-Initiated Payments (SIP): Suppliers “pull” and process VCN payments from buyers that have securely set specific parameters for designated single or multiple payments.

Buyer-Initiated Payments (BIP): Buyers define parameters and “push” VCN payments to suppliers for designated single or multiple payments.

Growth Trends

While the majority of payments are still made by check, these numbers are declining. The growth of purchasing card use continues at double-digit rates fueled by efforts to automate, realize cost savings, and reduce cycle time, effectively improving cash flow. One top area for growth includes expanding into new spend categories with ePayables. The 2018 RPMG Purchasing Card Benchmarking Survey reported EAP spending grew, on average, by 10.9% per year. Going forward, 75% of all EAP-using respondents expect increases in EAP account spending over the five year period from 2018 to 2022. EAP spending is expected to rise to $127 billion by 2022, a 42% increase from 2017. The major reasons for expected growth in EAP spending include increased supplier acceptance of EAP, efforts to target commodities for EAP payment, and efforts to target high-dollar transactions for EAP payment.1 The CPA interchange rate that has been introduced takes this into account, enabling continued growth and effectively lowering the merchant discount fee for suppliers on these higher-dollar payment transactions.

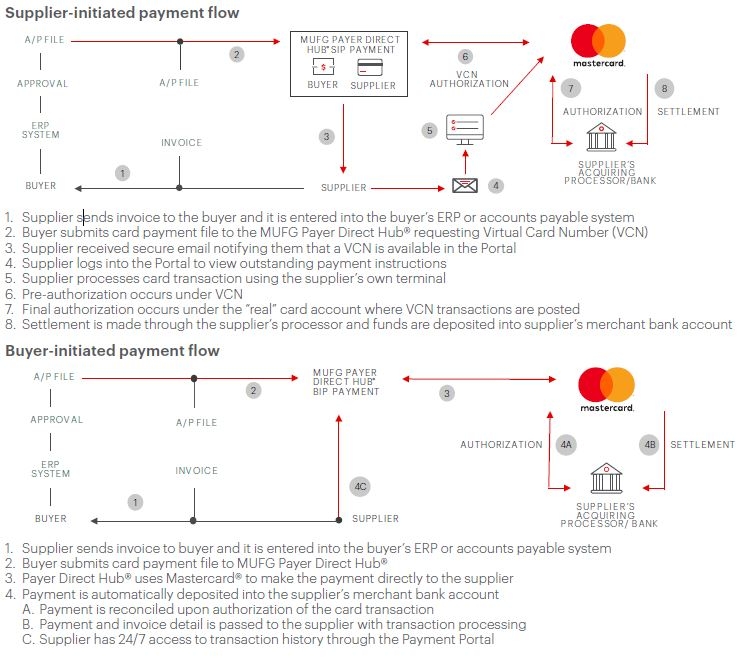

Snapshot: SIP and BIP Models

Most companies cite ePayables as the preferred payment when looking to expand their card payment reach into new categories and take advantage of existing cost savings and process improvements. While several different models have emerged, buyer-initiated and supplier-initiated are the two main categories.

SIP solutions have been in place for several years

SIP solutions have been in place for several years

- No plastic, dynamically generated, processed at the point of sale as “key entered” or “card not present”

- Supplier receives secure email or accesses a portal to obtain account number and “pulls” the payment

- This is similar to a check payment or purchasing card phone order as the supplier controls when the payment is processed

Pros

- Supplier controls payments

- Increased transaction security (buyer parameters)

- No Federal 1099 reporting (Federal Form 1099K) as of 2011

- Reduces buyer/supplier follow-up communications with more timely payments

- Improves reconciliation with VCN as unique identifier

- Batch process multiple payments—AP reconciliation

- Supplier receives remittance detail with payment, enabling reconciliation improvements

Cons

- Supplier required to initiate payment

- Initiated payments must be reconciled against completed card transactions

- Reentry required if card is declined

BIP solutions have more recently been implemented

- No plastic, dynamically generated, processed securely through buyer’s card provider network

- Buyer “pushes” payment to the supplier which is similar to an ACH payment

- BIP has been referred to as Straight Through Processing (STP)

Pros

- Expand into larger AP spend categories

- Buyer controls payments—parameters and timing

- No Federal 1099 reporting (Federal Form 1099 K) as of 2011

- Buyer not required to maintain supplier’s bank information—reduces fraud, eliminates declines, re-work

- Supplier not required to initiate payment

- Supplier receives remittance detail with payment, enabling reconciliation improvements

- Can combine multiple invoice payments with detailed data in single transaction (larger ticket, lower fees)

Cons

- BIP system requires Supplier Merchant Setup (one time)

Conclusion

Incorporating a flexible ePayables solution into your payment continuum is paramount to expanding into strategic- and higher-spend categories, achieving enterprise-wide goals. Your target suppliers form the foundation of these goals. By focusing on a level playing field approach that highlights a win-win outcome, you will create lasting partnerships with suppliers, driving mutual success.

“Leveraging your bank partner’s experience by tapping into their segmentation tools and expertise can give you the head-start needed for success in evolving your ePayables landscape,” states Ranjana Clark, Head of Global Transaction Banking. The transformation process to optimize payments with ePayables is an ongoing endeavor requiring your cross-functional team to be persistent, follow and create best practices, and make adjustments throughout the journey. Implementation is just the start. Look to your bank partner for expertise with:

- Regular program reviews

- Program administrator support

- Sharing of industry news and best practice materials

- Product innovation

- Transforming your AP department to become a more strategic enterprise-wide partner

The foregoing white paper is intended to provide general information about commercial cards and is not considered advice from MUFG Union Bank, N.A.

Certain products and services described in this document are provided by MUFG Union Bank, N.A., a member of Mitsubishi UFJ Financial Group (MUFG), and are marketed under the MUFG and Union Bank® brands. Online applications supporting these products are branded Union Bank. Other products and services mentioned may be offered and marketed by other MUFG entities.

(1) RPMG Research Corporation (www.rpmgresearch.net) has been conducting an Electronic Accounts Payable Benchmark Survey every three years. Partial results of the most recent survey, conducted in 2018, are publicly available at: https://rpmgresearch.net/Products-View/product_id=89