Holistic strategies to improve your cash conversion cycle and maintain supply chain stability

Dramatic changes in the economic landscape, exacerbated by the global pandemic, have companies seeking creative and flexible ways to address their financing and liquidity needs, and their treasurers focused even more intently on working capital.

At the same time, to ensure manufacturing and production continuity, companies recognize the need to protect and shore up their supply chains. One way they are doing so is by offering suppliers access to liquidity necessary to sustain their businesses.

The emphasis on optimizing working capital, combined with the desire to support suppliers’ liquidity needs and keep them financially sound, has many companies evaluating a holistic approach to their payables strategy. A variety of payables solutions—such as ePayables, dynamic discounting and supply chain finance—work together in a complementary way to meet both working capital and supply chain stability goals.

A critical metric

A key metric in evaluating a company’s financial health is their cash conversion cycle (CCC) or the time it takes for a company to convert inventory and sales less the amount owed to create those goods into cash. The metric considers how much time a company needs to sell its inventory, also known as Days Inventory Outstanding; how much time a company waits to receive payment on their receivables, also known as Days Sales Outstanding; and how much time a company waits to pay its bills without incurring penalties, also known as Days Payable Outstanding. The mathematical formula looks like this: Cash Conversion Cycle = DSO + DIO – DPO

The realization of sales, along with the management of inventory and outstanding payables are three critical levers that can influence operating efficiency, which is why treasurers and analysts alike monitor them. The more efficient a company is in managing these levers, the lower their cash lifecycle number will be.

On its own, the number may not be meaningful depending on the industry in which a company operates. But when tracked over time and compared with competitors, you begin to see how a company can manage operating efficiency and working capital

Once you know how many days are in your cash conversion cycle compared with peers, performance can be improved by adjusting one or more levers in the formula to shorten your cash cycle. For instance, you can lengthen DPO by extending payment terms, or you can reduce DSO by automating billing processes, carefully managing, and/or selectively selling your accounts receivables.

Companies have historically managed their supply chains independent of the impact on working capital. Leading companies recognize the importance of strong collaboration across their enterprise, especially during this pandemic.

Partnering with Sourcing and Procurement groups to understand the strategic value of CCC improvements, and a willingness to join forces with Treasury and Accounts Payable can start a company on the path to finding solutions that work for the entire enterprise.

What are your working capital objectives?

Managing working capital requires a thoughtful approach, and the objectives your company sets will direct you to the most appropriate financing strategies.

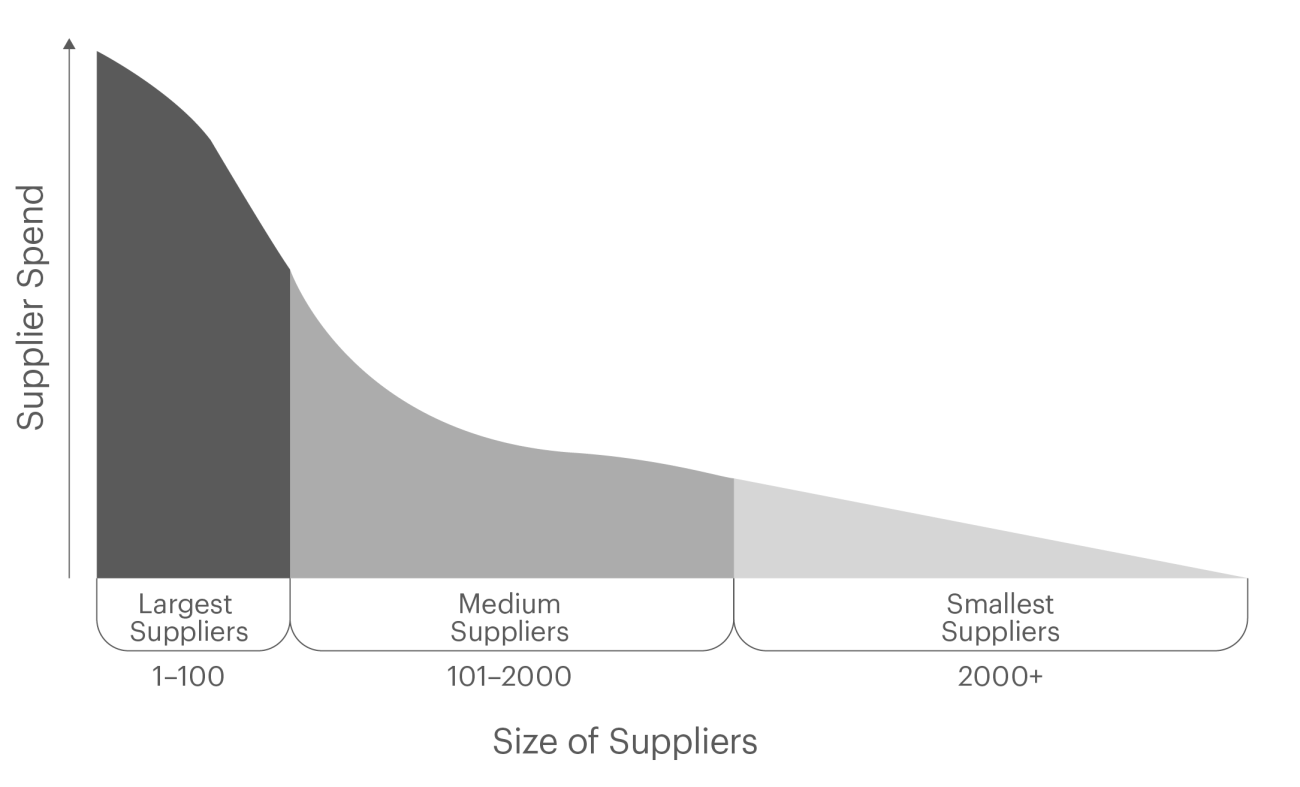

For instance, if your organization needs cash and views balance sheet optimization as a primary goal, supply chain finance for your largest suppliers might be a tool to explore.

On the other hand, if you have excess cash on hand, or you’re more focused on improving operating margins, you might want to turn your attention to dynamic discounting for medium and smaller suppliers, or as an add-on to your supply chain finance program.

Or perhaps you simply want to improve process efficiencies, while also driving cost savings across accounts payable. In that case, electronic payments, and commercial or virtual cards might be right for you. These payment solutions allow a company to gain between 30-105 days of float on consolidated billing, while earning rebates on card purchases. Process efficiencies are gained through a reduction in the time required for the AP department to process invoices and initiate payments.

But there is another strategic objective that holds sway during an economic downtown: maintaining strong, stable supplier relationships. When suppliers are cash constrained, offering liquidity at a lower cost than they might be able to secure on their own can be a welcome lifeline. In turn, you are not only strengthening your trade relationships, but also securing your critical supply chain.

Educate yourself on the benefits of these programs to determine the best way forward for your company.

A closer look at supply chain finance

Let’s start with supply chain finance (SCF) and for purposes of this discussion, let’s call your company “the buyer.” By employing supply chain finance, buyers can standardize payment terms, and strengthen supplier relationships by helping their suppliers get access to cost-effective financing. At the same time, buyers lengthen their DPO and increase control over accounts payable processes.

With this solution, the buyer approves invoices from participating suppliers and sends them to a bank. The bank then makes an early payment to the supplier at a discount, while the buyer pays the bank at a later date. Simply put, the buyer extends payment terms while the supplier receives financing at favorable rates.

Launching a supply chain finance program can be a highly integrated process to connect into your company’s ERP system. Some banks offer a solution with limited or no IT integration, which some companies use as a first step to introduce early payment to select suppliers as an internal proof of concept, while other companies, perhaps those more resource-constrained or with fewer suppliers, try SCF before expanding to a full-scale program.

From a supplier’s viewpoint, they receive payment quicker and improve their own cash conversion cycle by reducing their DSO. Typically, these early payments are at a lower financing cost than their cost of debt, and the cash can be used as an alternative source of liquidity or for other purposes.

Understanding dynamic discounting

Dynamic discounting gives buyers flexibility to choose when to pay their suppliers in exchange for a lower price or discount on the goods and services purchased. The “dynamic” component refers to the option to provide discounts based on the date of payment to suppliers. The earlier a payment is made, the greater the discount.

Unlike SCF, where the buyer uses a bank to execute early payment, with dynamic discounting, the buyer uses their own excess cash to provide early payment.

However, not all ERP systems are equipped to calculate the discount dynamically without significant time and development effort to capture the invoice approval process, and streamline the discount calculation and payment processes. As well, you need experienced people to enroll suppliers into the program.

Here is where your bank can help. They have a wealth of inhouse knowledge and resources to engage with suppliers to ensure program adoption, which can be a welcome relief for resource constrained companies. And their tech platforms are already configured to discount dynamically as well.

How does dynamic discounting differ from SCF? Well, a buyer still sends their approved invoices to the bank, which calculates the early payment discount amount. But this time, rather than pay the supplier directly, the bank notifies the buyer of the correct amount they should pay the supplier.

For example, if a buyer’s standard payment terms are 60 days, a supplier may be open to providing a small discount if a buyer would pay in 30 days. The bank calculates the discount amount and tells the buyer how much to pay on the invoice.

Typically discounts range from 8-12% APR for early payment, which can reduce invoice value and improve income statement performance. By providing early payment directly to a supplier, a buyer achieves a higher return on its excess cash compared to placing their cash in short term investments, yielding a lower return.

Meanwhile, a supplier receives payment quicker, for a small discount, and is able to reduce their DSO, positively impacting their own cash conversion cycle.

CASE STUDY

Holistic solution to meet corporate cash flow needs

ABC Company, a Fortune 200 manufacturer, approached a bank to develop a solution that would deliver quantitative cash flow improvements across their payables with minimal supplier disruption. A secondary objective was to preserve cash, and optimize their balance sheet.

Analysis of their cash conversion cycle in comparison with competitors showed that their payment terms varied significantly; they were a 60-day pay compared to industry average of 90+ days for large suppliers, a 45-day pay for small suppliers; and their average weighted cost of capital was 8%.

The bank suggested a supply chain finance program for strategic suppliers to address their cash preservation needs and extend payment terms.

As well, the bank recommended a concurrent dynamic discounting program for their medium-sized to smaller suppliers that led to an average annualized yield of 12% compared to placing their excess cash in short term investments.

Finally, the company synced their Treasury System with the bank’s automated platform, which allowed them to gain visibility into their financial metrics in real time to improve their business decision making.

As a result of these programs, the company was globally able to unlock $30M in cash flow from supply chain finance, generate over $15M in cost savings from dynamic discounting, and benefit from operational efficiencies and $5M in rebates from ePayables, as well as a 63% supplier adoption rate.

Examining the impact of ePayables

The rise of ePayables has expanded commercial card use. An ePayables program creates a virtual card number that can be used for a single payment or multi-use where the card number can be turned on and off each time a payment is made.

Card acceptance by suppliers is practically ubiquitous these days, so some buyers look to take greater advantage of card opportunities to implement an ePayables program.

Buyers can extend DPO by utilizing card repayment terms and Visa/MasterCard payment channels.

As well, buyers can convert paper-based payments to electronic payments similar to a Purchasing or T&E card program, generating rebates on their spend.

In addition to an acceleration of cash flow, which is always welcome for suppliers, they benefit from reduced payment processing time, the ease of electronic remittances, and the potential ability to negotiate merchant fee reductions with Visa/MasterCard.

Increasingly many companies are taking advantage of these solutions to optimize their balance sheets, improve their P&L and preserve cash. Supply chain finance provides value through payment term extension and freeing up cash, while dynamic discounting provides a higher return on excess cash along with quantitative cash flow improvements, and ePayables provides process efficiencies and cost savings.

A working capital optimization roadmap

The roadmap for exploring these strategies and achieving your working capital goals includes several stops. Before you get to your destination, you should consider the following:

- Supplier segmentation. A simple rule of thumb is that SCF tends to be more effective when used with strategic suppliers due to their importance to your supply chain stability, and ability to generate significant cash flow improvement given their size and scale. A bank can help analyze your supplier base to define that group.

Dynamic discounting tends to be more attractive for a buyer’s small to medium-sized suppliers, due to the predictability of obtaining their cash earlier, and in effect, improving their own Days Sales Outstanding.

ePayables is most effective with suppliers who already accept cards due to their potential ability to negotiate merchant fee reductions which will impact their income statement, in addition to accelerating their own free cash flow and concomitant improvement in DSO.

- Procure-to-pay process opportunities. Another part of your journey is to review your procure-to-pay process, which involves functions that generally impact expense management and working capital.

Review your organization’s cycle of activities from invoice receipt to payment, and seek opportunities to compress the timeline. For starters, do you receive a paper invoice or an electronic one immediately loaded onto an electronic platform for processing? What about your approval process, and how can it be streamlined to reduce overall cycle time?

The faster you approve invoices, the faster you can pay them to maximize cost savings. If a supplier offers a 2% discount if you pay in 30 days vs. 60, what discount might you earn if you pay in just 15 days? - Payment terms alignment. Here you have an important opportunity to conduct a deep dive across your enterprise to align and standardize payment terms within payment categories. You may find an overlap of suppliers from one division to another with different payment terms. Use this time to normalize terms for these cross over suppliers as well as within different spend categories.

- Internal engagement. To successfully initiate working capital solutions, you need buy-in across the various departments within your organization that will be impacted. If Treasury is leading the effort, for example, buy-in from Sourcing/Procurement and Accounts Payable are key to your success.

Best practice shows companies that designate a senior project champion within the organization who can work across different groups have a much greater likelihood for success. Sourcing or Procurement need to sign off on changes to payment terms and contracts, and may be particularly sensitive to how changes affect any compensation incentives related to early payment savings. Accounts Payable need to agree to changes that impact invoices and bank integration with their payment systems, as well as responding to supplier inquiries about payments. - Supplier engagement. Building a successful program depends on supplier selection, engagement, education, and onboarding. Significant people resources are needed to do this time-consuming work.

Fortunately, banks can help design the segmentation and develop a supplier outreach program and engagement process for you. They start by helping you segment your targeted suppliers into different groups based on priority, with engagement taking a different form for each group. Your highest-volume suppliers may require a high-touch approach, for example, so you may want to call jointly with the bank to introduce and promote your program.

With the next tier of suppliers, the bank may offer a webinar to educate suppliers about the program and the value gained from their participation. Finally, for remaining suppliers, you may direct the bank to send a persuasive letter on your letterhead to encourage participation.

No need to pick just one

In these complex times, companies that are able to foster cross-departmental cooperation can leverage one or more solutions to improve the cash conversion cycle, free up working capital, and shore up their supply chain.

The good news is you don’t have to choose between supply chain finance, dynamic discounting, or ePayables. If you select a bank with the necessary expertise to deliver these solutions, you can improve your working capital by employing more than one solution simultaneously to engage a majority of your suppliers.

Using supply chain finance with your larger, more strategic suppliers will enable you to optimize your balance sheet, and employing dynamic discounting with medium to small suppliers can improve your operating margin, while implementing ePayables can lead to significant process efficiencies.

The combination can be potent, better enabling you to meet your working capital objectives.

ABOUT MUFG

Globally, MUFG provides banking expertise in more than 50+ markets from more than 2,700 locations. More than 180,000 professionals serve the needs of corporate and institutional clients and retail customers around the world.

Our supply chain finance, dynamic discounting, and ePayables solutions help clients reduce financing costs, improve working capital, and free up liquidity in their cash conversion cycle.

For more information, please contact your MUFG relationship manager or Greg Hurst via email: rhurst@us.mufg.jp,

This white paper is intended to provide general information about working capital solutions and is not considered advice from MUFG and MUFG Union Bank, N.A. Certain products and services described in this document are provided by MUFG Union Bank, N.A., a member of Mitsubishi UFJ Financial Group (MUFG), and are marketed under the MUFG and Union Bank® brands. Online applications supporting these products are branded Union Bank. Other products and services mentioned may be offered and marketed by other MUFG entities.

MUFG Americas

1251 Avenue of the Americas

New York, NY, 10020-1104, United States