Faced with Excess Cash in a Low Interest Rate Environment?

Explore how to optimize your returns with dynamic discounting

Excess cash on hand? Thinking about how to improve operating margin, or utilize that excess cash? Dynamic discounting may be the answer for you. Depending on your metrics and capital investment hurdle rates, you may find this solution attractive to improve your margin as you redeploy cash. Dynamic discounting is an early payment program that enables buyers to increase net income and standardize payment terms while helping their suppliers manage their own cash positions with greater visibility into payment timing. Buyers gain the flexibility to choose when to pay their suppliers in exchange for a lower price or discount on goods and services purchased. The “dynamic” component refers to the option to provide discounts based on the date of payment to suppliers.

Surge in Available Cash

In our discussions with clients, many have revealed a surplus of available cash. In fact, S&P 500 companies saw a record high 33% in cash holdings in total debt plus cash and short term investment in Q4 2020 v. prior quarters.1 As well, they are strategizing how to invest their cash for better returns.

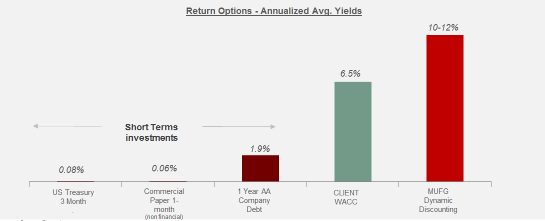

We have found that for our clients, implementing a dynamic discounting solution leads to a typical average annualized yield between 10%-12% APR, significantly outperforming most internal investment hurdle rates or returns on short term cash.

For one client, their weighted average cost of capital was 6.5%. And with short-term investment returns so low and an investment hurdle rate of 6.5%, they would practically be “paying” their banks to hold their deposits. By receiving an average 6% higher yield than their hurdle rate through employing dynamic discounting, this client saw the benefit of this solution versus any interest received on a three month treasury investment.

A Closer Look

Companies searching for ways to invest excess cash are able to earn far greater returns through dynamic discounting than today’s short term cash investments are able to provide. And as we enter a post-pandemic economy, dynamic discounting gives companies the opportunity to lower expenses by taking discounts on their supplier invoices.

Buyers who have implemented a dynamic discounting program see it as an efficient strategy to drive value for their company and move a majority of suppliers onto the program with minimal impact to their own resources. In addition, buyers may combine the launch of a dynamic discounting program with a strategy to standardize payment terms that align with corporate goals and initiatives.

Why would suppliers join an early payment program? Certainly for the benefit of receiving cash quickly. Dynamic discounting provides a cost effective alternative liquidity source helping suppliers lower their accounts receivable, reduce Day Sales Outstanding, and free up credit lines while diversifying their cash sources.

Suppliers also benefit from better cash flow planning through visibility into approved invoices and payment timing accessed 24/7 via a remittance portal along with dedicated multilingual customer service teams.

A Deeper Dive into Savings

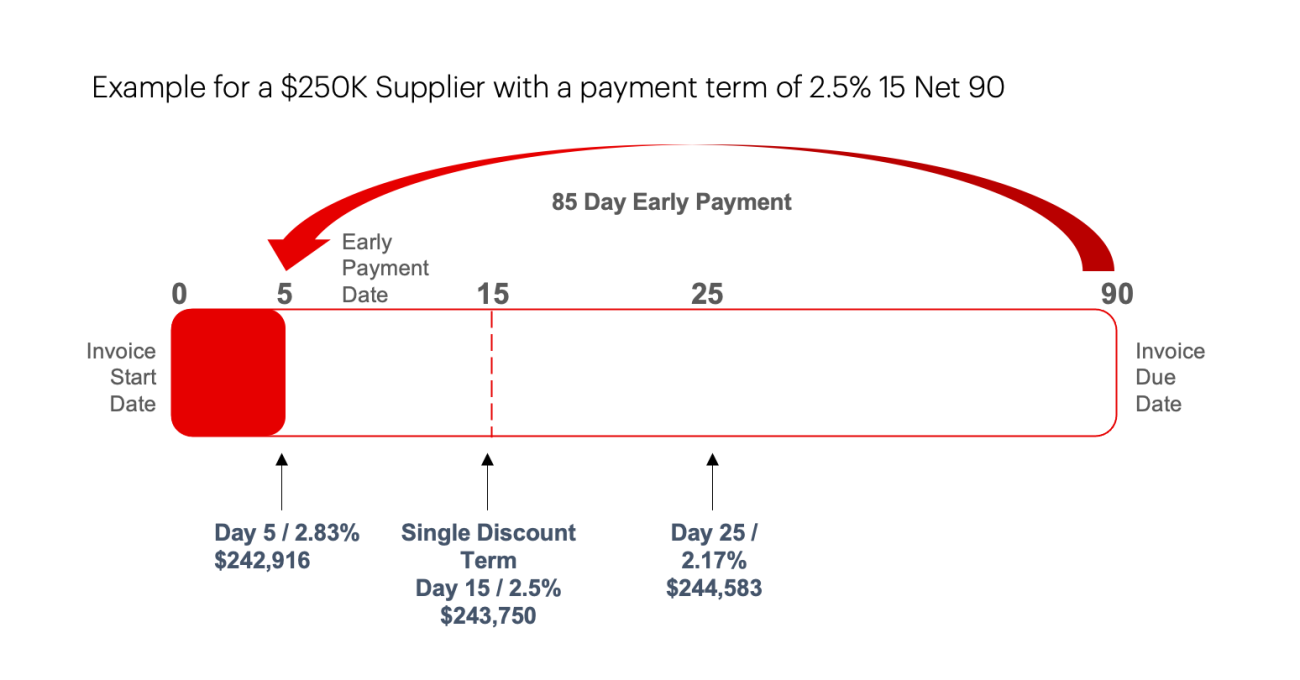

Traditional single discount payment terms do not allow discounts to be applied after a specific date, whereas dynamic discounting allows discounts to happen daily and up to the payment due date, thus allowing the buyer to maximize discount opportunities.

Let’s examine Buyer A, who has a 90-day payment term with a supplier and purchases $250K worth of goods. Using dynamic discounting, this buyer could discount invoices any day before its payment term vs. a traditional single discount term (Day 15 in this example), after which no other discounts are available.

What if Buyer A is able to pay before Day 15? Using a traditional single discount term method, Buyer A can hold the invoice until Day 15 and pay at a 2.5% discount rate vs. paying before Day 15 with discount rates as high as 2.8%.

The incremental savings generated through dynamic discounting would deliver higher discounts generated at Day 5 to discounts generated from Day 15-90 at a lower discount rate. Buyers are able to employ these discounts on a sliding scale as necessary while tracking discounts at an invoice level.

A Peak into How to Launch a Dynamic Discounting Solution

Once you decide to use dynamic discounting, what are the steps required to launch the solution? The first is to choose either a bank or a fintech firm provider and do your due diligence. You may want to consider that while most fintechs are privately held companies, banks, as regulated entities, are more stable with policies and procedures, people and technology resources required to meet the most demanding client requirements.

It is also important when conducting your due diligence to ask questions that will help you achieve a high supplier adoption rate, such as:

- what is the makeup of their supplier onboarding team in terms of experience? Are they in-house, outsourced, or subcontracted, etc.? Do they have international coverage?

- what is their approach to solicit suppliers? What supplier education do they provide? What are the language skills of the onboarding team?

- is the provider flexible in creating solutions to meet your needs, processes, segments?

Lastly, you want to ensure that the provider has the relevant expertise to help Procurement as they standardize payment terms. They should be able to assist in such areas as providing peer benchmarks, guiding your company to develop a holistic strategy and execution plan to extend terms, and be able to provide training to your Procurement staff.

Gaining internal alignment is key. As with any project involving change, ensure that you have signoff from Treasury, Procurement, Information Technology, and Accounts Payable, and a firm commitment to engage in the project’s success. Ensuring that your system can adopt dynamic discounting as an ERP integration with your bank or fintech’s platform can typically take from four to six weeks. While your IT colleagues manage that process, your Procurement and Account Payables teams can work with your bank/fintech’s supplier onboarding team to segment suppliers and create communications plans and materials.

For example, your Procurement team in reviewing supplier payment terms would segment suppliers into categories such as strategic/core suppliers vs non-core suppliers. ESG or supplier diversity (i.e., minority-owned/women-owned/veteran-owned) factors may be considered. By grouping the supplier population into segments, you can create different payment strategies aligned with your social responsibility metrics as well.

Who Takes the Lead?

Initially, the Procurement team takes the lead to establish terms and introduce dynamic discounting to suppliers. Once Procurement gives the ‘green light,’ the bank/fintech’s supplier onboarding team springs into action to market the program and engage with suppliers to explain its benefits.

What's the Benefit?

Companies who implement a dynamic discounting solution are able to strengthen or improve key financial ratios in their supply chain process such as lowering their cost of goods sold (COGS) or Selling General & Administration (SG&A) expense in exchange for the one time working capital adjustment with little to no upfront implementation cost.

As well, companies can mitigate the risk of supplier disruption and support business continuity in their supply chain while improving loyalty by strengthening suppliers’ ability to manage their own liquidity needs.

On the operational front, buyers capture early payment discounts at any point to invoice maturity date, automate early payment terms to reduce missed discounts, capture additional savings on an invoice by invoice basis and leverage a third party to build a program in partnership with Procurement.

Which Suppliers to Choose?

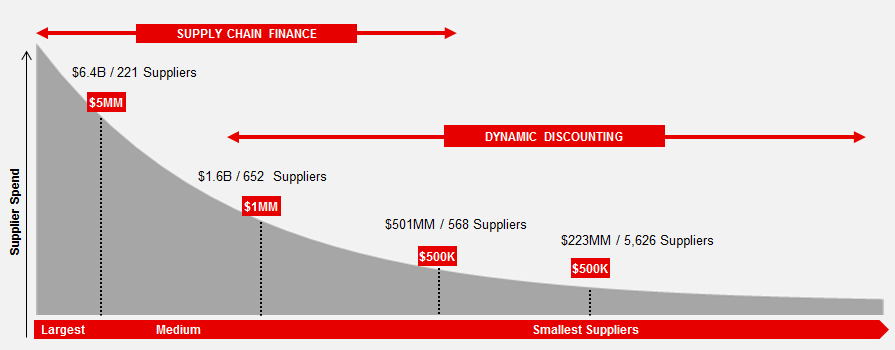

Our clients have found that the best suppliers to target for a dynamic discounting program:

- Are medium to small suppliers (often under $3M in annual spend) where short term liquidity is typically cheaper than its cost of debt

- Have financial targets to improve day sales outstanding (DSO) and cash flow, and

- Need a source of liquidity when bank credit is tight, especially during lean economic cycles.

It is important to note that these suppliers typically comprise 50-80% of a buyer’s total number of suppliers and account for approximately 20-40% of a buyer’s total spend.

So is Dynamic Discounting Right For You?

If you are looking to make use of your company’s excess cash, dynamic discounting is a powerful solution to help you meet your working capital objectives while at the same time strengthening relationships with suppliers.

With a thoughtful roadmap, internal alignment with important stakeholders across your enterprise, and the right partner to help you engage with your suppliers, you are well on your way to realizing the benefit of dynamic discounting.

For More Information

Please contact your MUFG relationship manager or Greg Hurst via email: rhurst@us.mufg.jp

Client #1: Meeting Operating Margin Savings Goals

Challenge: A multinational financial services firm was looking to meet operating margin savings goals, while increasing their efficiency ratio compared to peers. Strategies employed to achieve cost reduction goals across the enterprise included reduction in workforce and real estate relocation. Examining third party vendor expense was next.

Solution: MUFG proposed a dynamic discounting solution which would allow this client to not only standardize payment terms in alignment with competitors, but also allow vendors to be paid faster by accepting a discount. Achieving cost savings targets and minimizing supplier disruptions was an added benefit.

The client wanted the stability of a bank vs. a fintech firm to help achieve their cost savings goals, and their program requirements were robust. They required a seasoned inhouse supplier acquisition team to help facilitate onboarding suppliers to their program; a well-reasoned strategy to standardize terms with demonstrated best practices for execution; and a platform to perform early payment discount calculations.

Result: In the initial phase of their program launch, the firm:

- Is on track to achieve $5M in discounts in the coming years

- 32% supplier adoption in Year 1 with supplier onboarding continuing

- 10% APR

- 95% retention rate for suppliers in the program

Now in Year 2, the firm continues to see the benefit of supplier early payment discounts, along with an increase in supplier satisfaction.

Client #2: Searching For Yield While Optimizing Working Capital

Challenge: A global industrial conglomerate was seeking to optimize its working capital metrics across different business units and countries through the use of early payment programs. This client already knew that they wanted a receivables purchase solution for their largest suppliers, but with a significant number of small to medium-sized suppliers, they also needed a solution to realize margin benefit and overall cost savings without significant disruption across their supply chain.

Solution: MUFG proposed a dual solution: receivables purchase for their largest suppliers, and dynamic discounting for their next tranche of suppliers – the medium-sized ones. The solution offered end-to-end processes that:

- were scalable with a global reach

- provided a methodology to convert their large supplier base

- delivered various payment options

- with minimal supplier disruption

Result: Post implementation of both dynamic discounting and receivables purchase solutions, the Company realized a yield of 12% APR through its dynamic discounting program and $50M-$60M realized supplier discounts in reduction of cost of goods sold year over year. As a combined effort, their receivables purchase and dynamic discounting programs realized over a $1B cash flow benefit through one proprietary bank platform.

About MUFG

Globally, MUFG provides banking expertise in more than 50+ markets from more than 2,700 locations. More than 180,000 professionals serve the needs of corporate and institutional clients and retail customers around the world.

Our supply chain finance, dynamic discounting, and ePayables solutions help clients reduce financing costs, improve working capital, and free up liquidity in their cash conversion cycle.

This white paper is intended to provide general information about working capital solutions and is not considered advice from MUFG and MUFG Union Bank, N.A. Certain products and services described in this document are provided by MUFG Union Bank, N.A., a member of Mitsubishi UFJ Financial Group (MUFG), and are marketed under the MUFG and Union Bank® brands. Online applications supporting these products are branded Union Bank. Other products and services mentioned may be offered and marketed by other MUFG entities.

©2021 Mitsubishi UFJ Financial Group, Inc. All rights reserved. The MUFG logo and name is a service mark of Mitsubishi UFJ Financial Group, Inc., and is used by MUFG Union Bank, N.A., with permission. Member FDIC.