ACH Newsletter

We are always striving to keep you up-to-date about the latest information that impacts your ACH service – the growth of Standard ACH and Same-Day ACH, upcoming NACHA rule changes, fraud prevention tips, and our new Product Toolkit service.

Standard ACH

2019 ACH Network Volume and Value – 24.7B transactions totaling $55.8T

In 2019, the ACH Network processed 24.7 billion payments, up 7.7% year-over year growth, topping the 2018 growth rate. This growth continues to prove reliable with standardized formats, cost efficiency, convenience and security. The ACH platform is more important than ever, while businesses navigate the Covid-19 pandemic and employees remotely.

Same-Day ACH

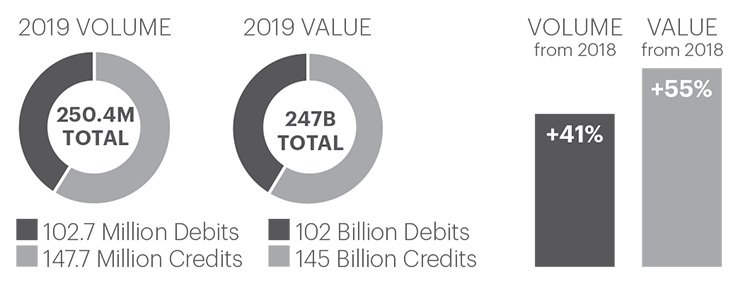

2019 Same-Day ACH Volume and Value – 250.4M transactions totaling $247B

Important Upcoming NACHA Rule Changes

There are several upcoming NACHA rule changes that could affect your ACH processes:

Third Same-Day ACH Processing Window – Effective 3/19/2021

NACHA is continuing to make Same-Day ACH more convenient for businesses, especially for those on the west coast. This new rule creates a third Same-Day ACH processing window that expands Same-Day ACH availability by 2 hours. This will allow Same-Day ACH files to be submitted until 4:45 p.m. ET (1:45 p.m. PT) – currently the latest Same-Day ACH files can be submitted is 2:45 p.m. ET (11:45 a.m. PT).

Supplementing Fraud Detection Standards for WEB Debits – Effective 3/19/2021

The existing rule will make it explicit that “account validation” is part of a “commercially reasonable fraudulent transaction detection system”. This rule will apply to the first use of an account number or changes to an existing account number going forward. The rule is neutral with regard to specific methods or technology to validate Receiver account information.

Enhanced Data Security Requirements for Payers’ Nonpublic Information – Phase I: 6/30/2021; Phase 2: 6/30/2022

This rule expands the existing ACH Security Framework rules to explicitly require large Originators, Third-Party Service Providers (TPSPs) and Third-Party Senders (TPSs) to protect account numbers by rendering them unreadable when stored electronically. Applies only to the DFI account number collected for, or used, in ACH transactions. This rule was originally planned to begin in 2019, however, it has been delayed until 2021 due to the disruption Covid-19 has caused in the workplace.

Phase I – The rule initially applies to ACH Originators/TPSPs/ TPSs with ACH annual volume of 6 million transactions or greater processed in 2021.

Phase II – This rule applies to ACH Originators /TPSPs/TPSs with annual ACH volume of 2 million transactions or greater processed in 2022.

Recent NACHA Rule Change Refresher

NACHA implemented two rules recently and we want to make sure you understand the impacts:

Differentiating Unauthorized Returns (R-11 Return Code)

Established on April 1, 2020, this rule provides ACH Originators clearer information when a Receiver claims that an error occurred with an authorized payment. The rule re-purposes the R11 Return Code as “Customer Advises Entry not in Accordance with the Terms of the Authorization”; i.e. when a debit entry is for an incorrect amount, or debited earlier than authorized. Originators receiving R11 ACH Returns will not need to obtain a new authorization from the Receiver, but simply correct the entry.

ACH Reversals

NACHA has a way to correct duplicate or erroneous ACH entries via the ACH Network. Under the Reversal Rule, Originators that have processed ACH entries in error, wrong amounts, or duplicate entries, can use the REVERSAL function to correct the error in ACH Online or ACH Exchange.

- Reversals are submitted to the ACH network within five (5) banking days after the Settlement date

- Originator must make reasonable attempt to notify Receivers for the reason for the Reversal.

Electronic Fraud Prevention Services

Help keep your business accounts safe from unauthorized electronic entries with our electronic fraud prevention services.

ACH Blocks

- Prevents any ACH Debit or Credit from posting to your business account

- Transactions are automatically returned to the Originating Financial Institution

ACH Positive Pay/Electronic Payment Authorization (EPA)

- Define vendors or trading partners that you authorize to debit your business account

- Define authorized payment limits by vendor

- Decision Pay/No Pay decisions for exception entries

Download the newsletter

Fraud prevention tips

Always verify any unusual changes in payment instructions over the phone or in-person, even when they are coming from a senior manager or recognized vendor.

Cybercriminals often spoof or hack the email of a vendor or senior executive to initiate fraudulent payment transactions.

Consider implementing Dual Approval to add another layer of protection.

Have questions about ACH services? Contact your treasury relationship manager for more information about our ACH services.

Product Toolkit

Our new Product Toolkit provides clients an easy way to manage administrative tasks related to ACH, Lockbox, Remote Deposit, and Returned Items in the Entitlement section of the Financial Center. Please contact your treasury relationship manager to learn more about this service.